By Howard Fischer

Capitol Media Services

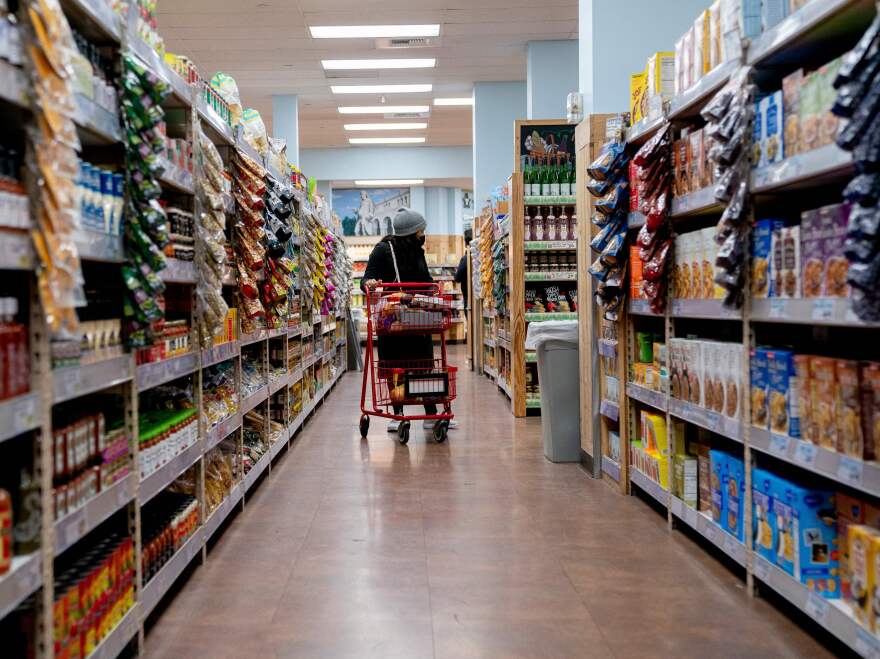

PHOENIX -- Arizona Gov. Katie Hobbs refused to say whether she will approve Republican legislation to eliminate the ability of cities to tax groceries and save affected Arizonans more than $161 million a year.

Her comments came a day after the state Senate voted along party lines to preclude cities from imposing the levy on food purchased for home consumption.

Arizona lawmakers eliminated the state sales tax on such purchases in 1980. But they left intact the ability of cities and towns to continue to do so to raise local revenues.

Asked during the gubernatorial campaign last year if she would work with Republicans to repeal the levy, the governor said "I'm not going to say 'no' to anything if there's a way to provide relief for Arizonans.''

On Tuesday, Hobbs sought to clarify her remarks.

"What I said is that I would look at all the ideas that we could put on the table to make things more affordable for Arizonans,'' she said. "But I continue to be concerned about the impact on cities and especially public safety budgets.''

Data prepared by the League of Arizona Cities and Towns show that the effects on those communities that continue to impose the levy would vary.

In El Mirage, for example, the tax raises nearly $1.6 million. But that is 11.7% of all sales taxes collected by the city.

That pattern is typical, with smaller communities hit proportionately harder.

Globe's tax on food is 15.6% of its total sales taxes, with a 13.8% hit to Nogales, 15.6% for Payson and 18.5% of Safford's sales taxes coming from grocery sales.

Still, larger communities are impacted, like the loss of more than $3.1 million for Sierra Vista, $5.9 million for Yuma, $14.8 million for Gilbert and nearly $17.9 million for Glendale.

But the question of whether there really will be lost revenues is less than clear.

Even Nick Ponder, a lobbyist for the League, told a legislative panel that approval of SB 1063 won't necessarily reduce the overall tax burden. He said that cities, having to finance operations, are likely just to increase taxes elsewhere, including possibly hiking the local sales tax rate on everything else.

That sentiment was echoed by Sen. Mitzi Epstein, D-Tempe, when the Senate voted to eliminate the tax.

"If you take away this tax, it'll probably be an increase in property tax or some other increase in their sales tax rate,'' she said, calling it "playing whack-a-mole'' with local taxes.

"When we change one tax that our cities are allowed to do, we're just whacking the mole,'' said Epstein whose home town has a 1.8% tax on groceries which raises more than $10 million a year. "It's just going to pop up and become another tax, another place.''

But Sen. John Kavanagh, R-Fountain Hills, had a different take on the measure.

"This is not a whack-a-mole bill,'' he said. "This is a bill that whacks the tax that whacks poor people.''

And Kavanagh said the food tax is regressive because everyone pays the same rate, regardless of income.

"It's also regressive because it deals with a commodity that people can't not use, people can't avoid, people can't escape, which is why it disproportionately burdens working poor people and working class people,'' he said.

Epstein, for her part, said the levy doesn't affect "the poorest of the poor.'' That's because federal law precludes states and cities from imposing sales taxes on purchases made with food stamps.

Kavanagh, however, said that most Arizonans are ineligible for the SNAP program.

"This is a direct response to inflation which is a burden on all families, especially poor and working class families,'' he said. "And this is relief for them.''

Sen. Janae Shamp, R-Surprise, agreed.

``Our voters are asking for this,'' she said.

``Our voters are asking for help,'' Shamp continued. `And that's exactly what this is.''

Hobbs, in discussing the bill to block cities from collecting the food tax, said Tuesday she doesn't want a "piece-meal approach'' to providing relief to the poor.

"I think there's a lot of other things I think we could be doing to make things affordable,'' she said.

Yet the governor continues to push a measure that would eliminate state sales taxes on diapers and feminine hygiene products, something that would save customers -- and reduce state revenues -- $40 million a year. She said singling out those items is different.

"It's something that has some impact for some folks,'' she said. At the same time, Hobbs said it really doesn't cut local revenues other than the share of state sales taxes they receive.

SB 1063 now goes to the House.

Hobbs last week vetoed a similar bill which would have eliminated the ability of cities to tax residential rentals. She argued, among other things, that there was no guarantee that tenants would benefit and that the landlords would not pocket the difference.

That argument is not available to her on SB 1063. That's because sales taxes are a line item on each shopper's receipt and grocers could not simply continue to collect them.